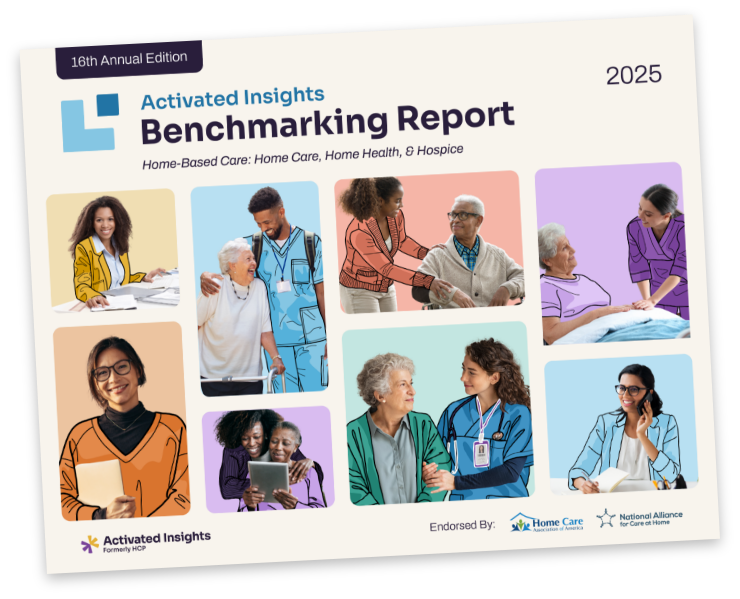

Turn industry benchmarking data into data-driven business decisions with these top trends, threats, and opportunities facing the home-based care industry this year.

Before the Benchmarking Report, a comprehensive home care industry study was unheard of. Home care providers were tasked with navigating the complex and ever-evolving post-acute care landscape by themselves.

Now, for 15 years, Activated Insights (formerly HCP) has been collecting crucial business insights from long-term and post-acute care providers across the nation to create an industry standard for business owners to benchmark their performance, and learn from experts.

Benchmark your performance against the industry with compelling new data points across home care, home health, and hospice.

As customer and employee satisfaction rises, training strategies are tested, and industry median revenue reaches the highest increase in five years, the 2024 Activated Insights Benchmarking Report is forecasting the patterns, trends, opportunities, and threats facing the long-term and post-acute care industry in 2024.

Make data-driven business decisions with these top findings on sales and marketing, recruitment and retention, training, finance, operations, and customer and employee experience.

Finding #1 – Sales & Marketing: Home-based care providers are putting their energy towards strengthening relationships with referral sources.

Priorities for long-term and post-acute care providers have primarily remained centered on employee recruitment and retention—until this year.

Now, providers are putting their focus more towards creating and strengthening their relationships with referral sources. This may be because word of mouth referrals ranks as the top marketing source for providers in home care, home health, and hospice, generating almost one third of all revenue.

As a result, home health and hospice saw a 12.2% median customer growth rate in the last year. Home-based care’s median customer growth rate increased by 4.4% to reach a staggering total of 10.5%, making it the highest growth rate within the last five years.

But at what cost? Customer acquisition costs are also the highest they’ve been in five years, rising by $208 in the last year to a total of $800 per customer.

However, those who tracked every inquiry made about their services saw almost a million dollar increase in revenue compared to those who only tracked some or most inquiries.

It’s never been more important to build up and manage your reputation in the industry.

In 2022, only one third of providers were taking advantage of reputation management software to solicit and collect positive reviews. Now, only one third of providers aren’t taking advantage of reputation and recognition management!

Finding #2 – Recruitment & Retention: A rise in home-based care staff turnover stems from inefficiencies in the recruitment process.

In the long-term and post-acute care industry, R&R doesn’t stand for rest and relaxation; instead, providers are still finding themselves caught in the revolving doors of recruitment and retention.

Over the last two years, the home-based care turnover rate has increased by over 12% to reach a total of 79.2%. That’s almost four in every five employees who will turnover within their first 100 days on the job.

And compared to home care and hospice, home health is having to consistently turn down new customers the most, due to a lack of employees. Which is a shame because customers turn over the least in home health with a 26.8% turnover rate, half of the rate in home-based care and hospice.

This industry-wide retention issue may begin with recruitment, as only 16.4% of home health and hospice nurses and 12.8% of home-based care applicants were hired. For home health and hospice, that’s a 25% decrease in applicant to hire ratio compared to last year.

This may be because although Indeed continues to be the most popular recruitment source, it produces the highest turnover rate of 88%, ultimately producing a short-lived “quick win” for recruitment numbers but a devastating retention rate.

Because revenue per employee has increased by almost $1,000 in the last year, the highest it’s been in four years, using automated recruitment tools like Recruit would be a worthwhile investment to start hiring staff who stay.

Finding #3 –Training: Professional home- based care training programs produce the highest ROI and cost the least in the long run.

As only 43.8% of home-based care staff and 55% of home health and hospice staff feel completely prepared to take care of new clients, providers need to cater their training programs to their employees’ needs.

While establishing a clear career path is one of the top strategies to retaining long-term employees, only 39.3% of providers have one.

Which is a shame because although in-person training initially costs the highest in employee acquisition expenses, it produces the most revenue per care employee at $17,071. Proving training to be a benefit for employee retention, customer satisfaction, and revenue rates.

But it’s not just your employees who are affected by the training you offer, your customers are most satisfied in the ability of your employees. 83.1% of businesses now offer specialty training with 96.4% offering dementia training.

With positive feedback like this, providers should start tracking hospital readmission rates to prove their quality care outcomes—a crucial industry KPI that only 24.1% of providers are doing.

Finally, the average home-based care employee receives five hours of orientation training and eight hours of ongoing. However, adding just seven more hours of training per employee could increase your revenue by over a million dollars.

See an increase of $1,103,291 in revenue by offering at least eight orientation hours and 12 hours of ongoing training.

Finding #4 – Finance: While the home-based care industry’s median revenue is at a 5-year high, a one-size-fits all billing approach is limiting potential earnings.

Providers are doing better financially than they have been for half a decade as median revenue rose by $292,723 in the last year, marking the largest annual increase in the last five years.

This may be attributed to the 23% increase in weekly billable hours for hourly care in the last year which comprised 85.6% of all service offerings—making it imperative for providers to recruit and retain hourly care staff to keep up with the demand.

However, revenue from hourly care is also the lowest it’s been in the last three years, dropping by almost 10% in the last year. Which may be why providers are also diversifying their top five payer sources: private pay, long-term insurance, Veteran Administration programs, Medicaid Waiver program, and direct Medicaid billing.

To make up the difference, an untapped market lies in billing based on skill level needed as 61.6% of providers are billing solely on length of visit, while only 29% of providers are billing for duration combined with level of skill.

Benchmarking your performance against the industry-standard outlined in this Benchmarking Report will help you uncover found-money opportunities like this and more.

Finding #5 – Operations: Family requests contribute to over 1/2 of all customers, but less than 1/3 of home-based care plans are meeting the family’s goals.

In the long-term and post-acute care industry, reputation is everything.

That’s because as only one in ten customers request their own long-term and post-acute care, over half of all business comes from family members requesting care for their loved ones. This is proving to be positive because the customer length of service increased by two months and the median customer lifetime value increased by $1,465 in the last year, the highest it’s been in the last four years.

Providers who invested in enhancing the care experience to increase customer satisfaction, like through Activated Insights, saw three times the average customer lifetime value.

However, although 94.9% of providers involve their customer’s family in their care plan, only 26.7% completely met the family’s care goals. This may be why 50% of customers found themselves stopping services to look for another provider who could offer them a higher level of care.

As a result, the reputation of your company within the long-term and post-acute care market affects both your employees, customers, and their loved ones.

Ensure you’re living up to your customers’ and employees’ expectations. Find out what else your customers and employees wish you would start, or stop, doing by conducting satisfaction surveys to become the company that employees recommend to their friends and customers recommend to their loved ones.

Finding #6 – Customer & Employee Experience: Home-based care providers that gathered and acted on feedback recruited 90% more employees.

Your dedication to providing quality care and employment is apparent, and it’s paying off.

Net Promoter Scores (NPS) and Employee Net Promoter Scores (eNPS) are back to pre-pandemic satisfaction levels! Customers are more satisfied than they have been in the last three years, while overall employee satisfaction is the highest it’s been in five years.

Lack of adequate training was a top complaint from both customers and employees for years. Which is why this year’s highest satisfaction scores are worth celebrating! Customers reported being most satisfied with their caregiver’s ability, and likewise, employees are most satisfied with their customer/client’s care plan matching.

The relationship between your customers and employees has never been stronger.

Unfortunately, both can attest to feeling the least satisfied in their relationship with their provider/employer.

In this year’s report, customers admitted they’re least satisfied with the level of communication they receive from their provider to the point where they would not recommend their provider to friends. Likewise, employees are least satisfied with the recognition they receive for their work.

Increase your credibility with referral sources by gaining a globally recognized and research-backed verification of a great employee experience. Great Place To Work Certification helps job seekers identify which companies genuinely offer the company culture everyone is talking about.

Next Steps:

Related Posts